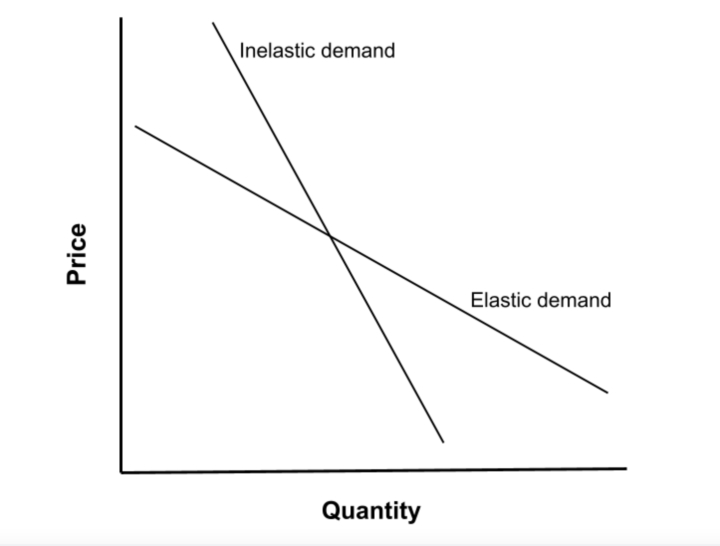

← elastic vs inelastic structural analysis Brody's blog: inelastic vs. elastic elastic vs inelastic on a graph Inelastic and elastic demand business diagram →

If you are looking for Elasticity and Tax Graphs 1 .docx - Elasticity and Tax Incidence When you've visit to the right page. We have 35 Pics about Elasticity and Tax Graphs 1 .docx - Elasticity and Tax Incidence When like Elasticity and Tax Incidence | Elasticity, Effect of tax - depending on elasticity - Economics Help and also Taxes, Elasticity, and DWL - YouTube. Here you go:

Elasticity And Tax Graphs 1 .docx - Elasticity And Tax Incidence When

www.coursehero.com

www.coursehero.com

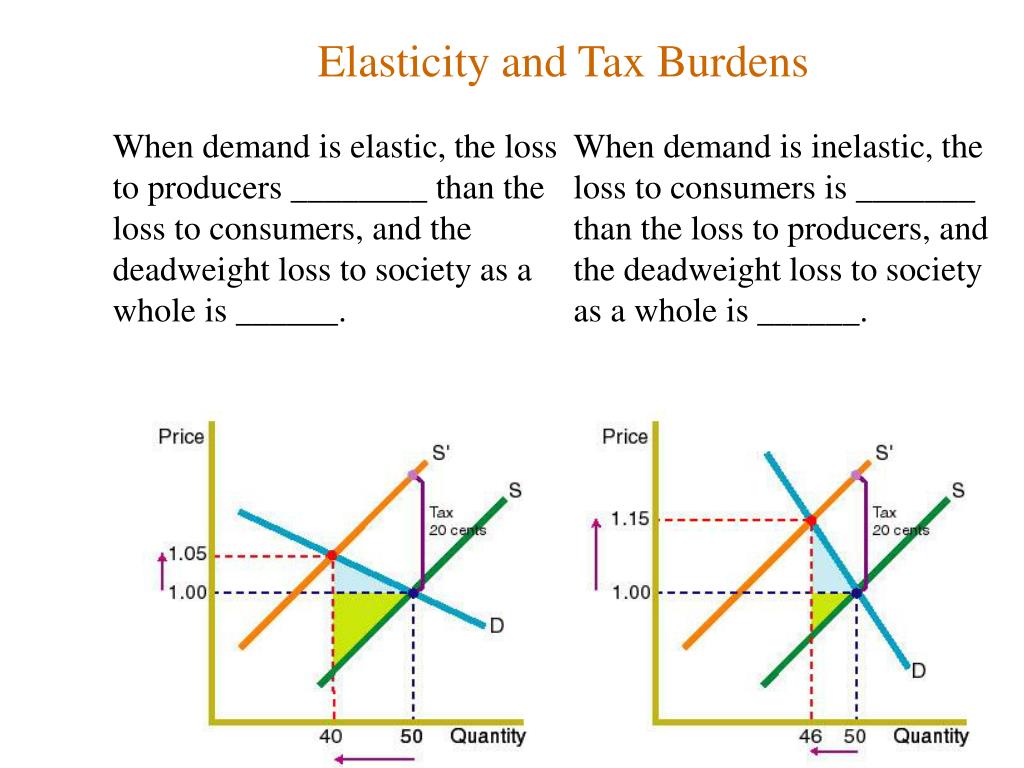

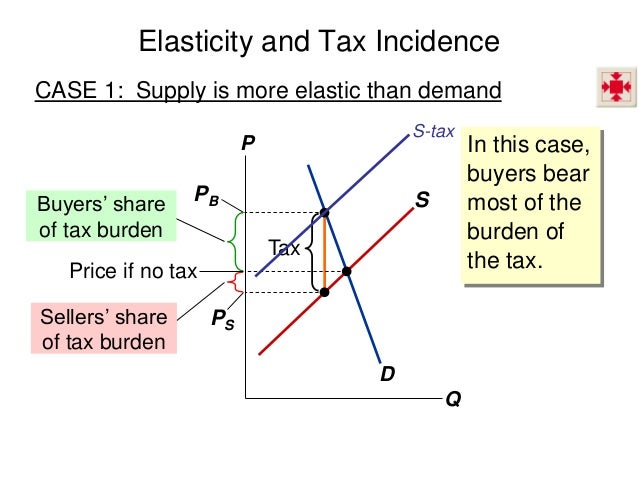

PPT - Elasticity PowerPoint Presentation, Free Download - ID:6537721

www.slideserve.com

www.slideserve.com

elasticity tax elastic demand when burden perfectly inelastic bear ppt powerpoint presentation burdens

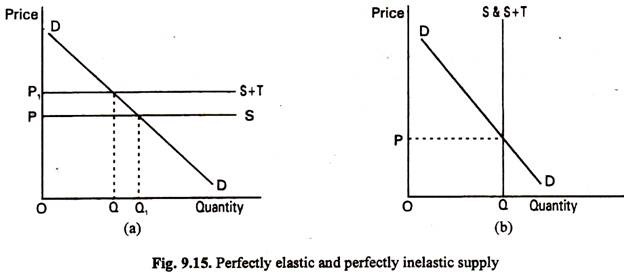

Effect Of An Indirect Tax On A Commodity (With Diagram)

www.economicsdiscussion.net

www.economicsdiscussion.net

tax indirect effect supply diagram inelastic perfectly commodity elastic articles related

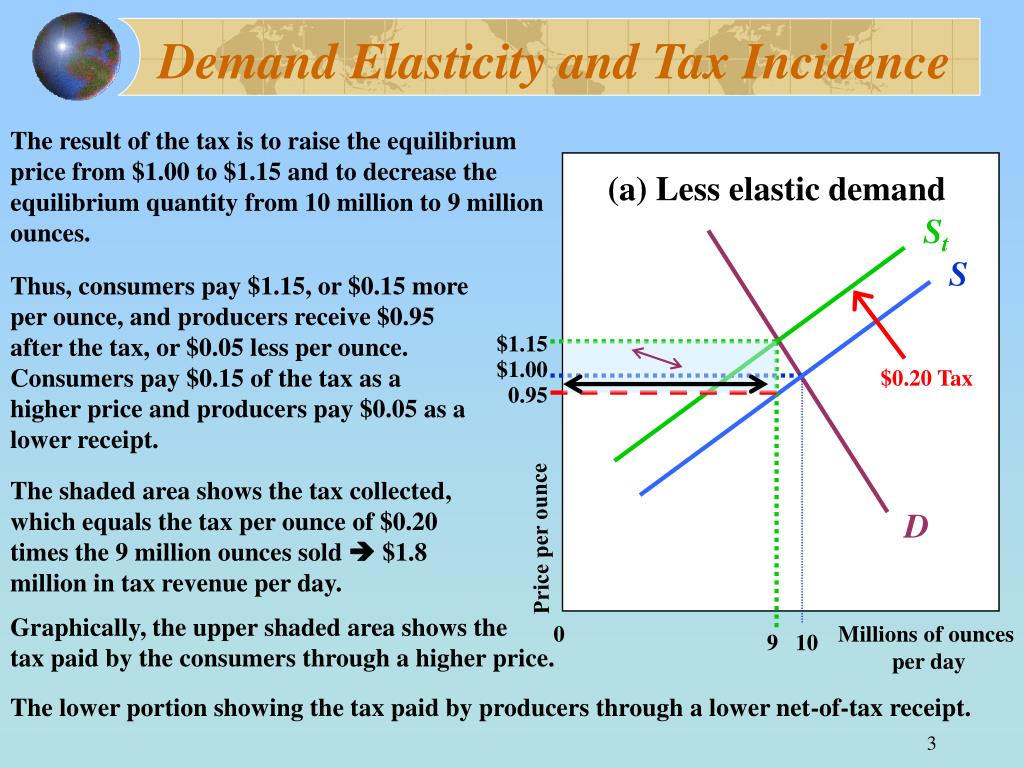

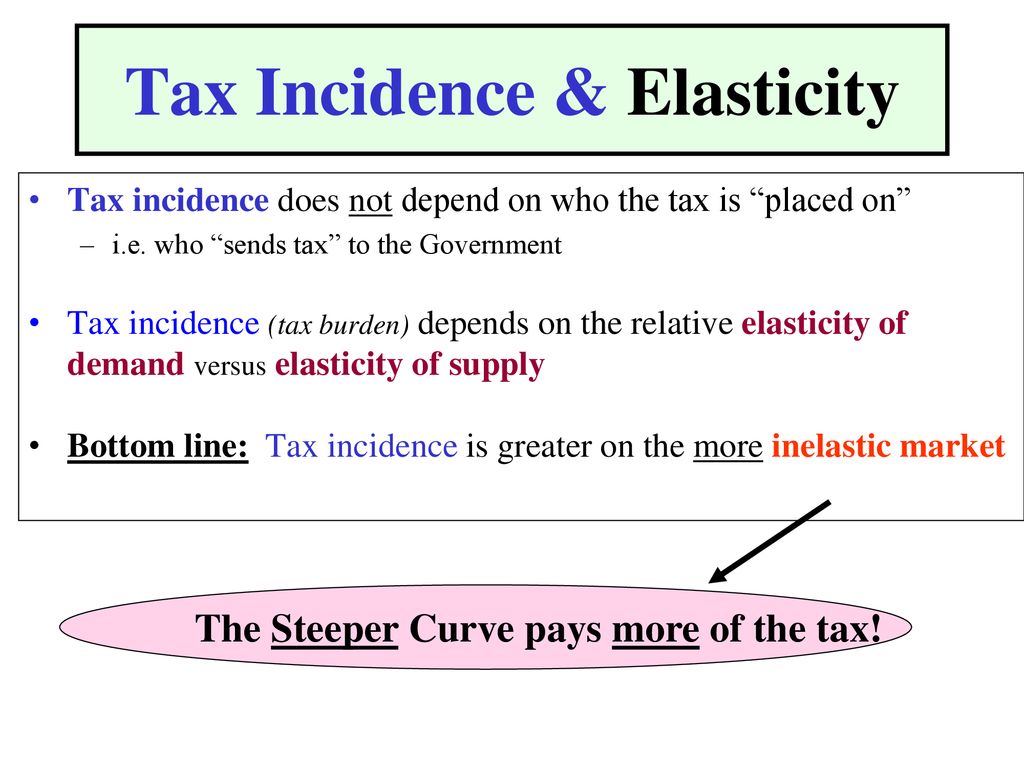

PPT - Price Elasticity And Tax Incidence PowerPoint Presentation, Free

www.slideserve.com

www.slideserve.com

tax incidence elasticity elasticities

Elasticity And Taxes – Microeconomics For Managers

uw.pressbooks.pub

uw.pressbooks.pub

taxes inelastic supply elasticity elastic microeconomics

Reading: Types Of Taxes | Microeconomics

courses.lumenlearning.com

courses.lumenlearning.com

microeconomics tax demand supply incidence elasticity excise burden elastic inelastic who buyers sellers bears bear taxes most effect graphs showing

Gov. Tax - Sales Tax- Elasticity & Tax Burden (Tax Incidence) - YouTube

www.youtube.com

www.youtube.com

tax burden incidence elasticity sales

Elastic Vs Inelastic Demand - Top 9 Best Differences

www.wallstreetmojo.com

www.wallstreetmojo.com

Elasticity And Taxes – Microeconomics For Managers

uw.pressbooks.pub

uw.pressbooks.pub

elasticity pressbooks

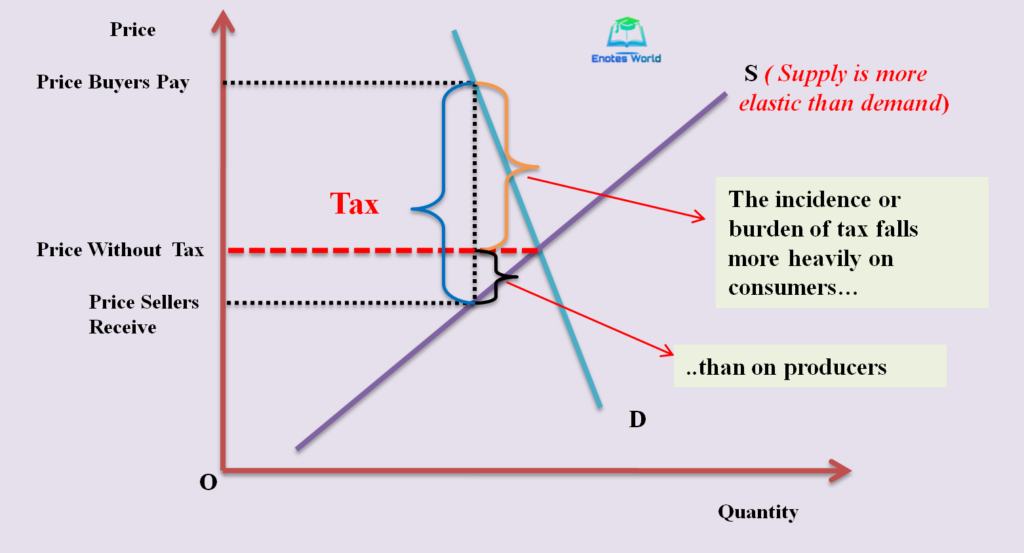

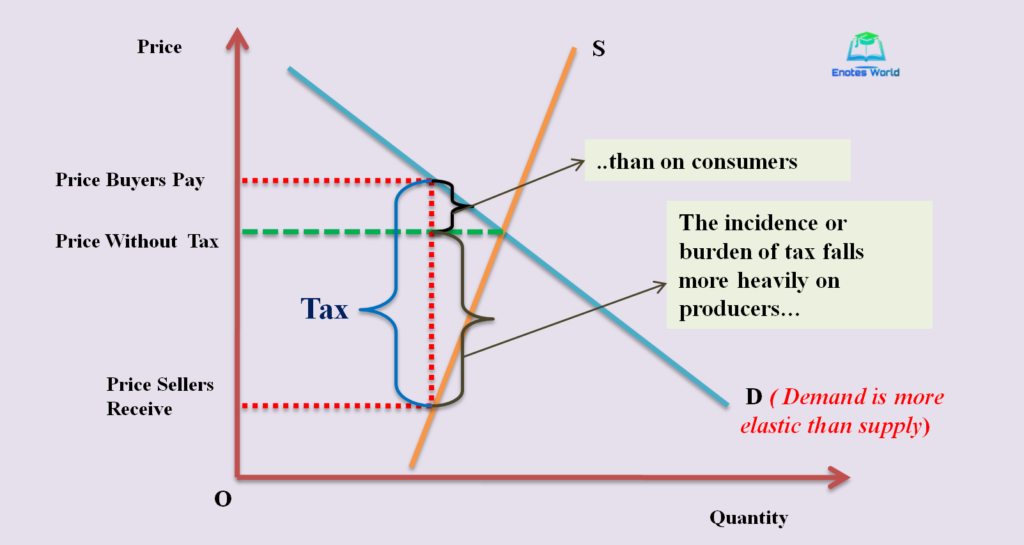

Elasticity And Tax Incidence-Application Of Demand Supply Analysis

enotesworld.com

enotesworld.com

elasticity incidence tax inelastic elastic taxing consumers

Elastic Vs. Inelastic Demand: What’s The Difference? | Indeed.com

www.indeed.com

www.indeed.com

Education Resources For Teachers, Schools & Students | EzyEducation

tax burden diagram demand consumers curve when inelastic elastic producers illustrate below economic

Taxes, Elasticity, And DWL - YouTube

www.youtube.com

www.youtube.com

elasticity dwl taxes

11.docx - Elasticity Of Demand And Tax Incidence − Perfectly Inelastic

www.coursehero.com

www.coursehero.com

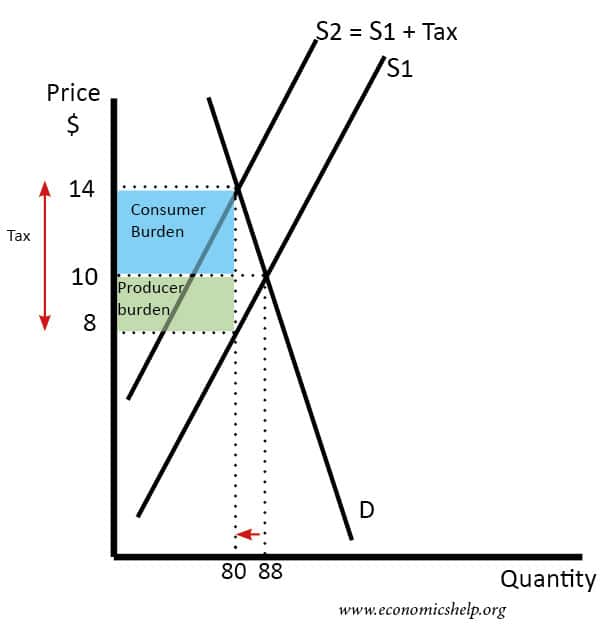

Effect Of Tax - Depending On Elasticity - Economics Help

www.economicshelp.org

www.economicshelp.org

tax effect elasticity demand inelastic economics consumer burden consumers pay depending rise amount

Using Diagrams, Explain How The Incidence(burden) Of An Indirect Tax

qeducation.sg

qeducation.sg

price tax demand elasticity indirect ped change quantity explain using diagrams incidence diagram burden economics affected define ib supplier responsiveness

3-9. Effects Of Tax On Perfectly Elastic And Inelastic Demand - YouTube

www.youtube.com

www.youtube.com

inelastic elastic

Tax Incidence & Elasticity - Ppt Download

slideplayer.com

slideplayer.com

Per-Unit Tax (Elastic Vs. Inelastic And Tax Burden, Part II)

reffonomics.com

reffonomics.com

Tax Incidence / Tax Burden - Wize University Microeconomics Textbook

-crop-1600193977787.png?1600193977) www.wizeprep.com

www.wizeprep.com

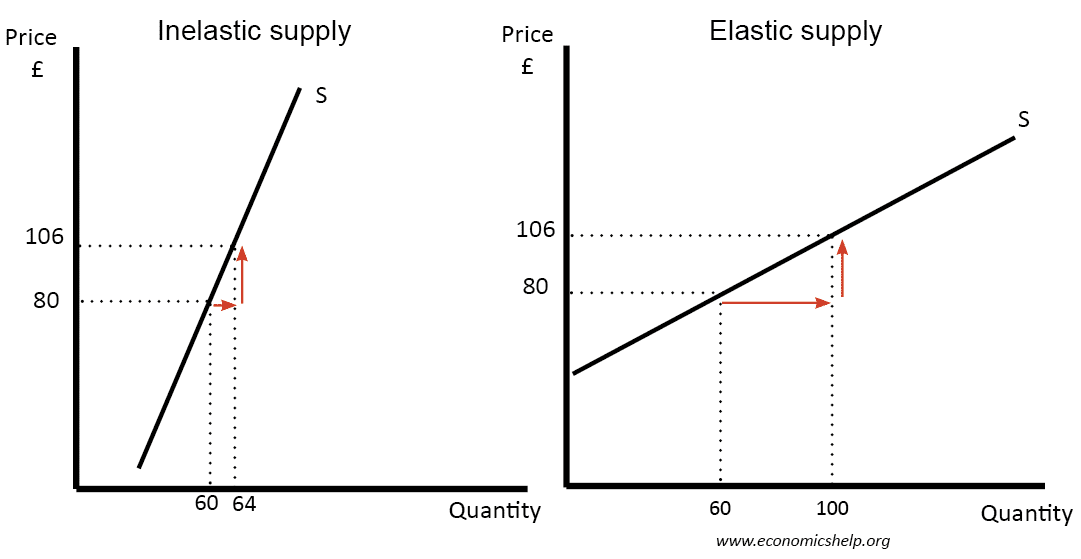

Price Elasticity Of Supply - Economics Help

www.economicshelp.org

www.economicshelp.org

supply inelastic elastic elasticity price economics pes quantity change equilibrium smaller help proportional causes say

3 Things To Know About Per-unit Taxes - AP/IB/College - ReviewEcon.com

www.reviewecon.com

www.reviewecon.com

tax elastic perfectly demand unit per burden excise taxes know things entire producers fall if will microeconomics

Tax Incidence Overview & Formula | What Is Tax Incidence? - Video

study.com

study.com

Effect Of Tax - Depending On Elasticity - Economics Help

www.economicshelp.org

www.economicshelp.org

elasticity incidence inelastic economics ped burden elastic revenue producer equilibrium depending total imposto fim income economicshelp depends paying

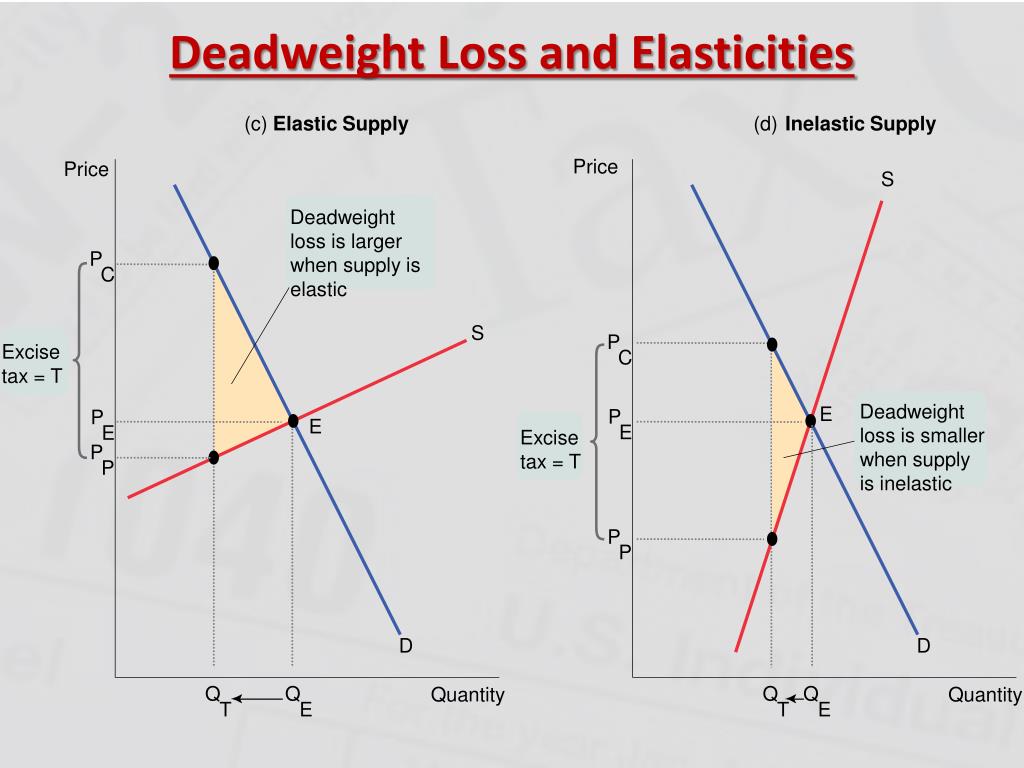

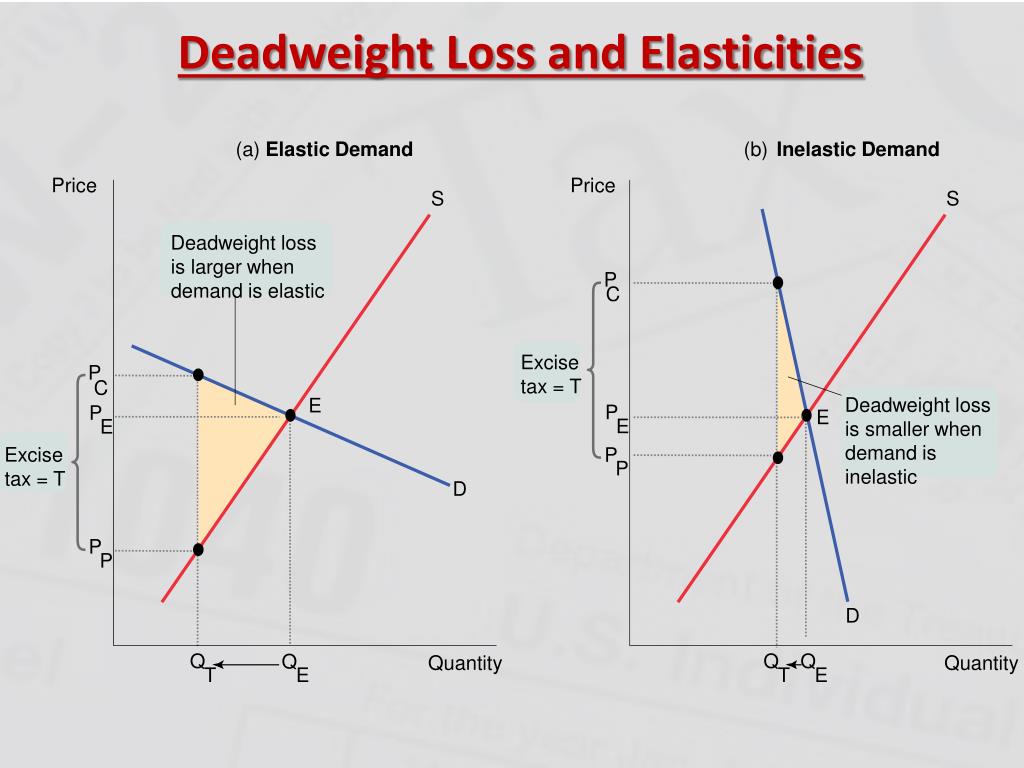

PPT - Tax Incidence And Deadweight Loss PowerPoint Presentation, Free

www.slideserve.com

www.slideserve.com

deadweight tax incidence inelastic elastic

Deadweight Loss Of Taxation

thismatter.com

thismatter.com

tax economics elasticity deadweight taxation demand supply loss burden good elastic revenue when seller showing buyer who graphs either not

Per-Unit Tax (Elastic Vs. Inelastic And Tax Burden, Part II)

reffonomics.com

reffonomics.com

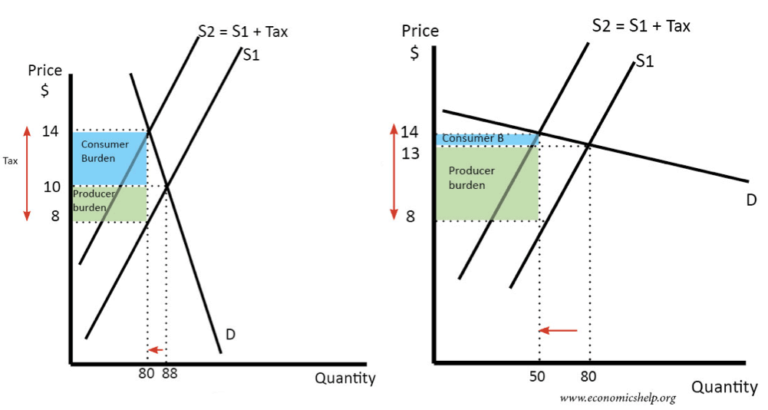

Elasticity And Tax Incidence | Elasticity

nigerianscholars.com

nigerianscholars.com

tax incidence elasticity consumers inelastic elastic burden producers excise paid econ macroeconomics wedge libretexts received microeconomics dolar

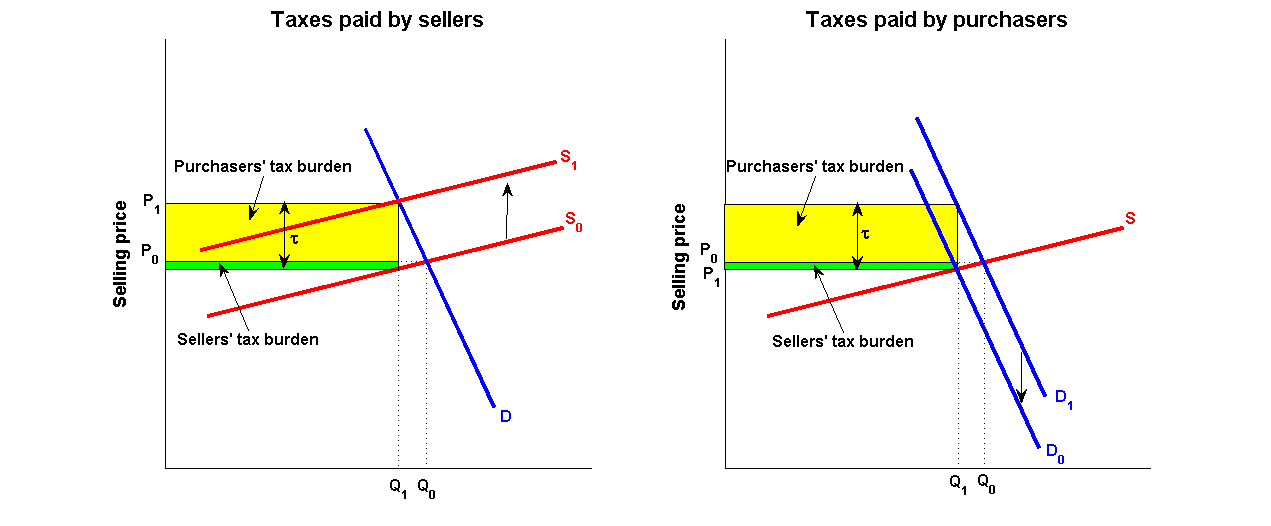

Elasticity And Tax Incidence

worldsensornews.blogspot.com

worldsensornews.blogspot.com

tax incidence burden buyers sellers elasticity economics share pay who worthwhile

Elasticity And Tax Incidence-Application Of Demand Supply Analysis

enotesworld.com

enotesworld.com

demand incidence elasticity inelastic enotesworld

Social Effect Of Tax Expansion In Case Of Elastic Demand And Supply

www.researchgate.net

www.researchgate.net

demand inelastic evident there

Taxes And Elastcity

www.slideshare.net

www.slideshare.net

taxes elasticity incidence sellers buyers burden elastic

PPT - Tax Incidence And Deadweight Loss PowerPoint Presentation, Free

www.slideserve.com

www.slideserve.com

deadweight tax elastic incidence inelastic

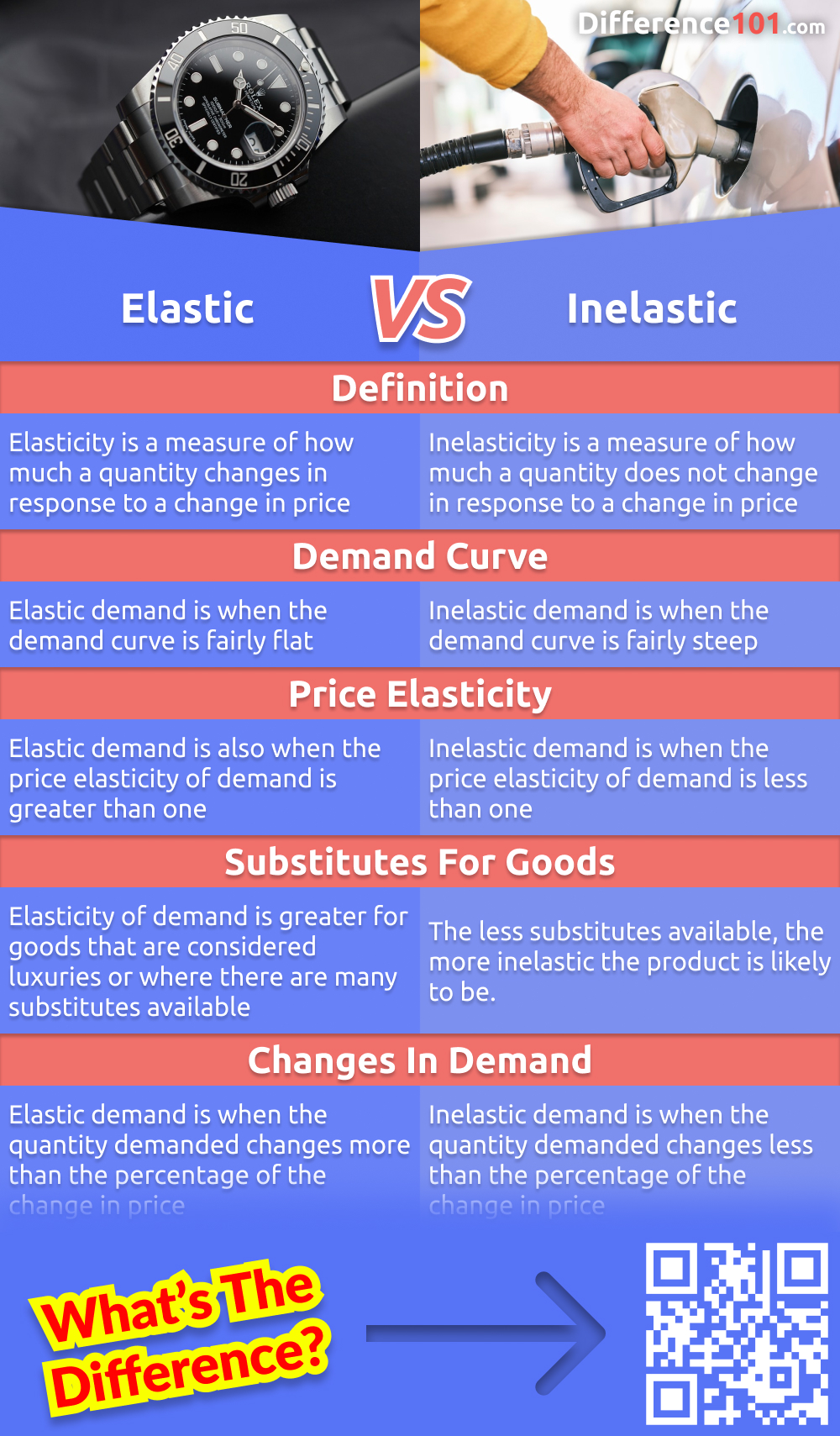

Elastic Vs. Inelastic: 5 Key Differences, Pros & Cons, Similarities

www.difference101.com

www.difference101.com

Tax Incidence And Perfectly Elastic Demand - YouTube

www.youtube.com

www.youtube.com

Tax elastic perfectly demand unit per burden excise taxes know things entire producers fall if will microeconomics. Microeconomics tax demand supply incidence elasticity excise burden elastic inelastic who buyers sellers bears bear taxes most effect graphs showing. Per-unit tax (elastic vs. inelastic and tax burden, part ii)